You have probably heard about platinum ETFs, but it is also essential to understand how it works before you start investing. You do not have to worry because it is simple to do it, but you have to follow a particular guide that will help you along the way.

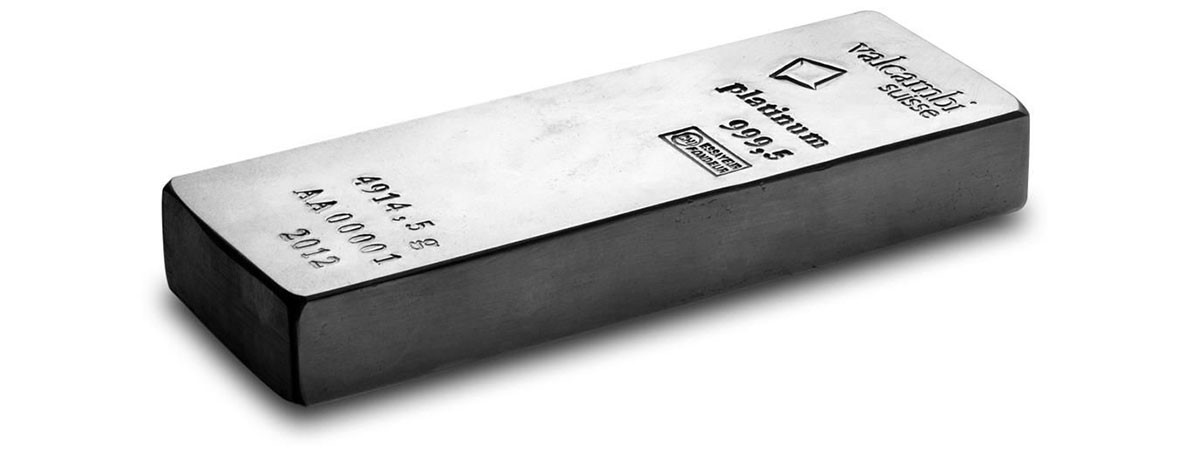

Investing in precious metals directly, which requires you to have physical metal tends to be appealing to most investors. The main reason for that is that they feel much more secure to have it in hands instead of looking at it on charts.

However, this particular security is just an illusion, but the problem arises when you wish to liquidate it because it will be highly challenging, especially if you own platinum eagles.

Since physical platinum is not that popular among investors, you will require plenty of time and hassle to resell it during the times of crisis. At the same time, platinum trading does not have to involve changing hands and owning a physical commodity.

You will be able to speculate on platinum without creating attention on yourself and possessing it, by implementing exchange-traded notes, which means that you will be able to enjoy all the way.

In case that you wish to own platinum, have in mind that it is least efficient when it comes to buying and getting physical form. Of course, everything depends on whether you wish to purchase coins or bars, but you will have the highest expenses with this particular perspective.

On the other hand, purchasing allocated platinum will reduce delivery expenses and everything that comes with it.

Therefore, you have to implement exchange-traded funds so that you can avoid getting delivery, and still, you will be able to leverage buying power so that you can earn a profit.

Remember that platinum futures will not involve changing hands and contracts for differences that will provide you the ability to get it covered by the broker. Most investors will want to prefer that the investment will present a specific amount of it, and you will have it on paper.

Therefore, when the value moves with the entire market, you will be able to achieve general efficiency, which means that you will be able to deliver the same goals as with owning the physical commodity.

ETFs Will Manage Transaction Expanses

In case you wish to buy platinum on your own, you will have to consider transaction costs as well as the ones that will help you control and own this particular ability.

As soon as you see the value of platinum and other precious metals, and you will be able to look at the overall expenses that will increase if you wish to purchase more.

In case you wish to purchase from a dealer, you will have to cover his costs as well as retail that includes markup, which may be significant. Therefore, when you buy an ounce of platinum, you will have to pay premiums that will make you lose money in the long run.

If you wish to purchase a few ounces of platinum and you wish to own a physical commodity, you will not be able to do it by yourself, which means that you have to consider a retail dealer.

At the same time, recently, the difference between market and expanses has been the theoretical one; the question is whether they will be unattainable.

When it comes to the ability that you wish to reduce the expenses and purchase it for an affordable price tag, you will be able to do it by teaming up with other investors.

The idea between platinum ETFs, and therefore, you will gain greater spread so that you can achieve individual orders for it. If you wish to understand more on exchange-traded funds, you should click here.

You Can Liquidate It with Ease

The best thing about ETFs is the possibility to liquidate everything with ease, which is not something that you will be able to do it with the physical asset. The ability of trading happens in real time, and that will provide you exceptional advantages when compared with other markets.

The entire idea with ETFs happens within seconds, in which you will be able to both purchase and sell a specific number of shares so that you can get what you want. When you own coins or bars, that will be highly challenging to resell afterward, which is why people choose ETFs?